August 2025 Features Update

Fixed Income Features

We have added a number of fixed income features to make it easier to probe the risk of more complicated fixed income portfolios, including arbitrage strategies with high gross exposures.

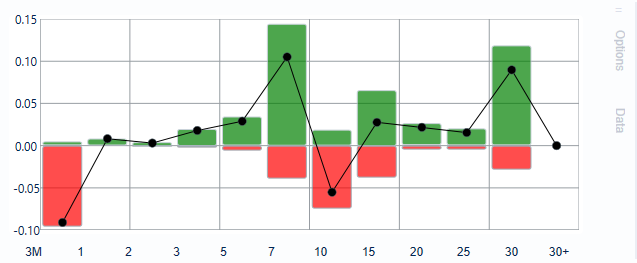

Chart enhancements: We have added a new chart type, “Partial $Duration (L/S)“. This is similar to the “Partial $Duration“ chart. Where the latter showed the net partial durations for the selected portfolio, the new chart shows long, short, and net partial duration, all in one chart. For both charts, there is now an “Options” tab that allows you to switch between: dollar duration and DV01; % and dollar values; to-maturity, to-call, and credit partials.

New fields: We have added four new fields: Gross $Duration, Gross DV01, Gross $Duration to-Call, and Gross DV01 to-Call.

New stress test: We have added a new on-the-run vs off-the-run stress test. You can find a full description in our list of stress tests. This is classified as a simple stress tests, but, as with many of our “simple” stress tests, the methodology is anything but. This new stress tests uses a new on-the-run versus off-the run spread adjustment, which can be paired with any existing fixed income stress test.

New Commodity Future Groups

For commodity futures, we have added two new grouping tags. Commodity futures and their derivatives can now be grouped by Future Family, and by the two new tags: Commodity Future Type and Commodity Future Sub-Type. For these two new tags, we currently have

Agriculture

Grains

Livestock

Oil Seeds

Softs

Energy

Freight

Metal

Base

Precious

Application Best Practices

In addition to new statistics and new add-ins, we frequently update the application to improve existing features and performance. To ensure your application stays up to date, you should restart the application at the start of each day, and be sure to accept any updates on launch.