Convexity

Convexity is the second derivative of the price of a bond with respect to its yield, normalized by the bond’s price.

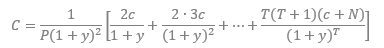

If a bond with a notional, N, and an annual coupon payment, c, has a yield, y, per annum on an annual basis, then the price, P, of the bond is

Note, P is the dirty price or economic value of the bond, and not the market quoted or clean price. The convexity is then,

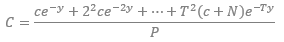

The precise formula for dollar duration will vary depending on how we define yield. For example, if, rather than quoting yield on an annual basis, we quote yield on a continuous basis, then the price of a bond would be

The corresponding formula for convexity would then be

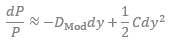

Convexity can be combined with duration to approximate the change in price of a bond, dP, due to a change in the yield, dy,

The percentage change in the price is then,

where DMod is the modified duration.